Grandor Assets process has evolved over the years and has been tested in virtually every market environment. It integrates insights from our Cyclical Forums, which anticipate market and economic trends over the coming 6 to 12 months, and the annual Secular Forum, which projects trends over the coming three to five years. These top-down views are complemented by bottom-up perspectives from specialists and quantitative analysis of individual securities and portfolio construction. Grandor Assets Committee, which is composed of senior investment professionals, drives decision-making on a daily basis to ensure that we exceed our clients expectation.

We make use of empirical data to identify strategies or regions that offer improving or deteriorating characteristics. We focus on the long-term opportunities where strategy tailwinds exist, while seeking to avoid those with headwinds. Our procedure supplements rigorous qualitative investment research with proprietary quantitative analytics to paint a complete investment due diligence picture. By deconstructing our returns into component strategies, regions or asset classes, we are able to identify where we can add value and are differentiated. Using quantitative portfolio construction techniques, we determine the optimal blend of strategies and managers given portfolio risk, return and liquidity objectives. At the portfolio level, we monitor performances and risks relative to our stated objectives. We also scrutinize underlying investment theses and ensure rankings are still valid at the manager level.

Grandor Assets aims to realize opportunities for our clients, shareholders and people while meeting expectations of sound corporate governance. We are in business to be profitable, but it is the way we do business that defines us. Grandor Assets high standards for conduct are underpinned by What We Stand For, and our long-held principles of Opportunity, Accountability and Integrity. We are committed to conducting our business in accordance with all applicable laws and regulations and in a way that enhances our reputation in the market. We are committed to ensuring our products and services are marketed appropriately and that clients are fairly treated. Business conduct and ethics are addressed within our existing risk management framework by establishing and maintaining an effective risk culture that drives good conduct. This is supported by a framework of policies, controls, processes and reporting mechanisms, in particular to manage compliance, legal, reputation and operational risks. Grandor Assets owns significant stakes in leading, high-quality, global companies. Through board participation, we work for continuous improvement of the performance of our companies. With our industrial experience, broad network and financial strength, we strive to make and keep our companies best-in-class. We always look at the opportunities and challenges facing each individual company. Our cash flow allows us to financially support strategic initiatives in our companies, capture investment opportunities and provide our clients with a steadily rising profit.

We have a dedicated team of risk professionals, with on-desk risk team and independent investment risk team. We recognize that risk management of alternative investments is a multi-dimensional activity, and no single method or measure can capture all elements of risk.

Detailed proprietary research identifies alternative investment managers that are generating differentiated return streams. Insights are shared within and across research groups to identify best-in-class, high conviction ideas.

Your gateway to alternative investment strategies

Research is what we do. As stewards of our clients’ capital, we constantly seek opportunities and explore new territories to know and understand our markets better than anybody else. We believe that superior top-down and bottom-up knowledge has helped us deliver value and returns to our clients during our 21-year history.

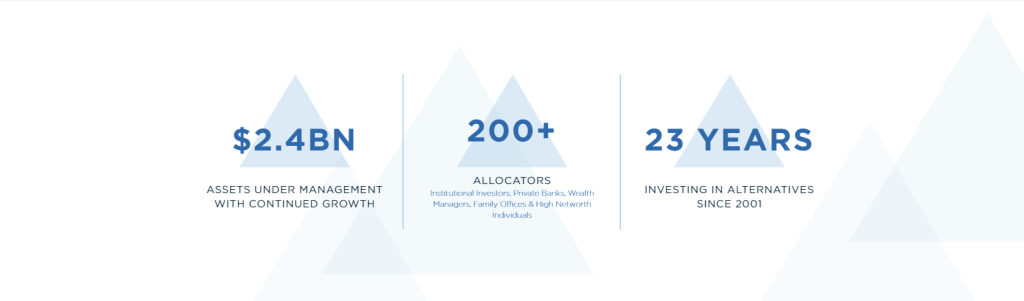

Launched in 2013, Grandorassets has established itself as a leading provider of comprehensive Hedge Fund solutions for a variety of clients. The Firm offers various products, advisory solutions, and tailor-made access to Hedge Funds to a diverse and global client base, which includes institutional investors, private banks, family offices, asset managers, and high net worth individuals.

Our team of experienced investment and research professionals is fully dedicated to select the best Hedge Fund and Private Equity opportunities for our clients, based on in-depth global research work and the Firm’s operational and legal due diligence and risk analysis. With offices in London, New York and Hong Kong, Geneva, and the British Virgin Islands, Antarctica Asset Management provides customized solutions for select clients and has been recognized by the industry through various nominations and awards.

Values

Our core values help us to deliver on our differentiated approach to infrastructure investment.

We are entrepreneurial

We take ideas from concept to reality. We equip our team and stakeholders with the tools and resources they need to think creatively and to make things happen.

We are collaborative

Trading and Infrastructure investment requires extensive collaboration to deliver the right outcomes for all stakeholders. We actively engage with our stakeholders to achieve this.

We deliver

We do what we say we will and more. We outperform our targeted returns and create value. On average, our portfolio companies have grown revenues by over 40% during our ownership.

We support a sustainable future

Infrastructure sits at the heart of the energy transition. We believe that improving the sustainable impact of our portfolio is completely aligned with enhancing the value of our investments.

Our People

Our high-calibre team of experts with investment, operational, technical and sector experience works across every stage of the investment life cycle. They generate and execute investment ideas and drive value creation across our portfolio companies.

Our proactive approach to creating value is delivered by our experienced asset management team, including our Industry Partners – former CEOs and chairs of major infrastructure businesses.

HISTORY

Founded in 2010, our entrepreneurial beginnings inspire our vision and approach today.

This approach focuses on sourcing bilateral investment opportunities, providing downside protection, inflation-linkage and industry-leading cash yield, and delivering proactive asset management to create value.